How To Freeze Your Credit Report In 3 Easy Steps

A few years back a close family member of mine was checking out at a local Walmart. As she packed up here things and left about a half hour later she got a phone call from her credit card provider explaining she had some recent transactions on her card from Las Vages, Sweden, and countless other places around the globe.

A few years back a close family member of mine was checking out at a local Walmart. As she packed up here things and left about a half hour later she got a phone call from her credit card provider explaining she had some recent transactions on her card from Las Vages, Sweden, and countless other places around the globe.

From here they stopped all further transactions because her identity had been obviously stolen. So in this article I’m going to give you a simple way to prevent this from happening you by showing you how to freeze your credit report.

What Is A Credit Freeze

Before I get into the how part of this article you may be wondering what is a credit freeze? To put it simply, it’s a way to prevent people from opening any new credit in your name.

For example, if someone were to obtain your name, address, date of birth, and your social security number they could easily open a new credit card in your name. Then these criminals will typically stake out your place waiting for the card to show up in your mailbox. Once they have the card it will be to late because the next thing you will get is a bill in the mail, and the crimials will be long gone.

However, when you freeze your credit report it doesn’t protect you from all identity theft. If someone were to obtain your credit card information they could use it since it is already an existing line of credit, however if they wanted to increase the amount of credit they would not be able to do so.

So now that we know what a credit freeze is let’s see how do you freeze your credit.

Step 1: Guidelines and Fees

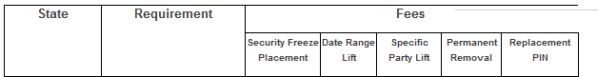

In order to freeze your credit you will have freeze it with all 3 credit bureaus, and you will typically have to pay a fee around $3 to $10 to each of the credit bureaus, however if you’re a victim of identity theft you will typically be able to freeze your credit for free. Below is a clip of what the fees are for Ohio.

If you would like to see what the fees are in your state you can check that out here.

Step 2: Complete The Online Application

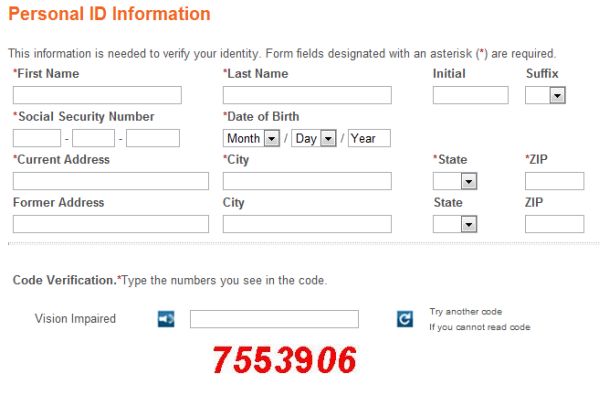

Once you’ve determined your states guidelines and and fees on how to put a freeze on your credit report the next step is to complete the sign up application. Their are two ways fill out the application. The first option is to sign up through certified mail , however this can take some time to do. That’s why I suggest the second option, complete the online application. Below is a link to each of the 3 bureaus freeze applications.

- TransUnion Online Freeze Application. Click here to get started.

- Experian Online Freeze Application. Click here to get started.

- Equifax Online Freeze Application. Click here to get started.

Once you get to the application page you will see a form pop up that will ask for some basic information. The picture below is what the basic sign up form will look like.

Step 3: Place A Freeze And Confirm

Step 3: Place A Freeze And Confirm

Once you’ve filled out the application you will need to select and confirm that you would like to place a credit freeze on your account. At this point you will also receive a 10 digit security PIN number through the mail. Once you have this done rinse and repeat with the other 2 credit bureaus.

I know this sounds to simple to be true but that’s it.

How To Thaw Your Credit

Finally, at some point you may want to thaw your credit so you can apply for credit or get a loan. To do this you will need a few things. The first thing you will need to decide is whether you want to permanently remove the freeze or temporaily remove it.

For a temporary removal you will need these things.

- Your 10 digit security PIN which you were given when you instated the freeze.

- You will need a date range in which the freeze will be lifted. Not all states will allow this.

- Information of the third party who will be accessing your credit info.

For a permanent removal you will need 2 things.

- Your 10 digit security PIN which you were given when you instated the freeze.

- 2 forms of identification.

To instate a thaw on your credit you can do that here.

- Equifax Thaw. Click here to get started.

- Experian Thaw. Click here to get started.

- TranUnion Thaw. Click here to get started.

Final Thoughts…

As a final thought on how to freeze your credit consider the reasons before you do it. If you are going to apply for a loan or new credit card it may not be a good idea to freeze your credit since you will need to access it on a regular basis. On top of that it will cost you a lot in fees as well.

So what are you’re thoughts? Feel free to share your questions, thoughts and comments below.