Online Loans: How To Get A Loan On Lending Club

If you read my recent article on how to get high return investments through a peer lending website called Lending Club you would have learned about how you could earn some impressive returns by investing your money to others through personal online loans.

So in this article I’m going to cover why an online loan is so great with Lending Club and show you how easy it is to set one up.

Why Lending Club

First off, with Lending Club they allow you to borrow up to $25,000 from other peers within the Lending Club investors network. These loans can run on either a 36 month loan schedule or a 60 month loan schedule.

Secondly, with Lending Club the rates are much better than other investments. To give a good example back several years ago I got a home equity line of credit from my mortgage company to do some home improvements around my house. The rate I got on my loan was 12%, and that was with excellent credit too. If I would have used Lending Club I could have gotten a rate for much less.

On top of that Lending Club loans have fixed rate which means the loan rate can’t change if you miss a payment or your credit gets worse. Unlike a credit card which can change rates at any point and time.

Reason To Get A Loan

Next, Lending Club will let you get a loan for many different reasons, in fact I thought about using them to get a loan to help put a down payment on a house. I also thought getting a business loan to help me purchase more materials for my business, and the best part is Lending Club will help do this.

So if your not sure what kind of personal online loans you can get here is an extensive list of what they offer.

- Debt Consolidation. Combine credit card debt into one simple fixed payment.

- Vehicle Loans. Need a car but can’t financing the traditional route, this is the perfect option, you can also use it to finance those extra toys you need as well like ATV’s, and Motorcycles as well.

- Home Improvement. Get home improvements done for less than you think.

- Business Loans. Need money to start a business or keep your current business running, Lending Club can do it.

- Special Events. Whether your getting married or need money for a special event in your life this could be a great option.

- Green Loans. If you want to turn your home into a green home and add some solar panels and make it more environmentally friendly this is the way to go.

- Cover medical expenses. If you need to pay for a hospital stay, a trip to the dentist, or even a surgery this can be the way to go.

- R&R Loans. Need to take that long awaited vacation, with Lending Club they can help you do that.

Obviously, it’s easy to see if you need a loan for almost any reason you can get it and if you need a loan for something I didn’t mention you can contact Lending Club and they will work with you to see if it will qualify.

What Are The Fee’s

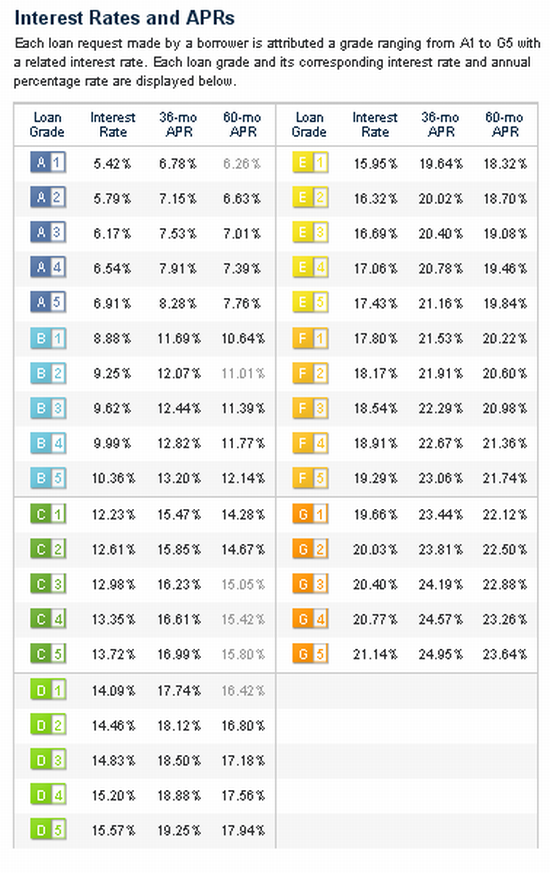

Now that we know what’s so great about Lending Club and what they can all do you might wondering what kind of fee’s are involved in doing something like this. The truth is the fee’s are incredibly cheap. To start look at the rate chart below.

Loan rates are broken down into different grades. A grades are the best and G is the worst. The best part about this you can also see what kind of rate you could expect. For example, if you have a credit score higher than a 720 you could qualify for a grade A loan somewhere between 6.26% to 8.28%. However if you have a score less than 600 you could expect a loan in grade G at high as 25%.

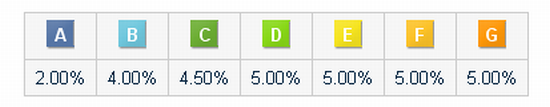

On top of that they also show you what kind of borrower fees they will add on depending on the loan grade you qualify for. For example they add a 2% borrowers fee for A grade loans while E, F, and G grade loans will add 5%. Finally I should also mention that their is no closing cost fee unlike traditional loans.

Finally, their are a few miscellaneous fees you should know about. The first is a missed payment fee, this fee is assessed every time miss a scheduled payment, which will be $15 for each missed payment.

Finally, their are a few miscellaneous fees you should know about. The first is a missed payment fee, this fee is assessed every time miss a scheduled payment, which will be $15 for each missed payment.

Second, their is also a late payment fee if you go 15 days over your missed payment. This will also result in another $15 penalty fee. So if you miss the payment once, make sure you make it before 15 days passes or you will be charged again.

Third and finally, their is a check processing fee. If you prefer to pay with a check every time you make a scheduled loan payment you will also be charged a $15 fee as well. So the best option in this case is to set up an automatic bank draft to debit the funds automatically and you will be able to avoid this fee completely.

That’s it, their are no other fee’s such as closing cost, and processing fee’s that most traditional lenders include in their financing. So now that we know what the rates and fees are you might be wondering how easy is it to get started.

How To Get A Loan

Getting a loan is simple, if you look at the picture below you can see how easy and fast the process really is.

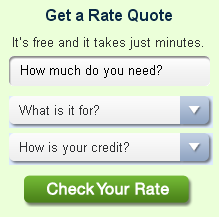

The first thing you need to do is apply for a loan. You will see a box that looks similar to the one at the right. First, it will ask you for how much you need for a loan, second pick the reason you need the loan, and third choose what your credit score is.

The first thing you need to do is apply for a loan. You will see a box that looks similar to the one at the right. First, it will ask you for how much you need for a loan, second pick the reason you need the loan, and third choose what your credit score is.

If you don’t know what your current credit score is check out my article were I show you how to find the cheapest credit score through a company called Credit Karma. This site will give you a free copy of your credit score and report in a matter of minutes.

Next once you’ve applied for the loan the funding process will start. This may take anywhere from a few hours to a few days depending on the amount of money you need. Finally once you’ve been completely funded you will begin paying back your loan through either a 3 year loan process or a 5 year loan process, however you can payoff the loan whenever you want with no penalty.

Call To Action

So are peer to peer loans online for you? To learn more and get a free rate quote check out Lending Club today . Letting money stand in the way of your dreams will ensure it stays that way but with Lending Club it can become a reality.

2 Comments