Getting My First Credit Card: What You Should Know Before You Sign Up

About seven years ago I did something that almost every adult American will do sometime in their life, I applied for my first credit card.

About seven years ago I did something that almost every adult American will do sometime in their life, I applied for my first credit card.

I was 22 years old and had no idea what kind of financial decision I had just made.

In this article, I’m going to cover what you should know before sign on the dotted for your first credit card.

I will also be giving you some simple rules to follow and I hope to help you understand why getting your first credit card is such a big deal and should be taken very seriously.

Excellent, good, fair, or bad credit, you can apply for a credit card here.

What Is The Purpose

Before I go any further trying to explain what a credit card is there is one thing you should know before you get one. The problem when most people get a credit card is they have no purpose behind why they are getting it.

This is why there can even be some confusion over having a personal loan vs credit card; people just aren’t quite sure what they want and don’t really know why they want it, but they go ahead anyway.

For example, I own two credit cards myself and they both have a purpose. The first one is for online purchases. I use it for that purpose because that card has a lower minimum credit line and it helps me keep track of my online purchases.

The second card I own is a Marathon Master Card Gas Card. This card is strictly used for the purpose of buying gas and is a much better alternative to paying cash all of the time. On top of that, it also gives me a 5% cashback reward on all purchases made at a Marathon Gas Station.

So now let me ask you what is your purpose for getting a credit card?

How Credit Cards Work

Next, when I had to apply for my first credit card I had no idea about how credit cards really worked. I had no idea about the fees, penalties, or rewards. So in this section, I will attempt to explain this all in a little more detail.

- 0% Intro APR. You might see this offer in a lot of credit card commercials claiming you will get 0% interest for the first six months or even for a full year. However, when that period is up they will normally charge you a regular interest rate fee on the balance that is left on the card. This will usually run from 7% to 14%.

- Balance Transfers. Balance transfers allow people to shift debt from one credit card to another. Some cards will have the benefit of offering0% balance transfers for the first 6 months and after that point will charge the normal 7% to 14% rate unless you can pay off the debt before the 6 months period expires.

- Annual Fees. A lot of credit cards will charge an annual fee but I prefer to stay away from cards like this. These fees can range from as little as $15 a year to $35 a year and higher. Just because a card has an annual fee doesn’t make it any better than the one without.

- Penalty Rate. Finally one of the most important things you should know about a credit card is that if you happen to miss payments for some reason you could be charged what is known as the penalty rate. This is the interest rate they can charge if you fail to make the regular monthly payments. A lot of times this rate will be around 30% to 33%.

Rules To Follow

Once you find the best first credit card there are some rules that you should follow in order to stay out of trouble and not get hit with the high-interest rates and penalty fees.

- Always pay off the card each month. Paying off the card each and every month allows you to never get hit up with paying interest. On top of that if you don’t keep it paid off each month you may find yourself falling behind each and every month unable to pay the debt off. The worst thing you could do is pay just the minimum off every month.

- Only use the card for its intended purpose. If you got the card originally to buy gas with and your using it to buy video games with you may end up building up more debt than you planned.

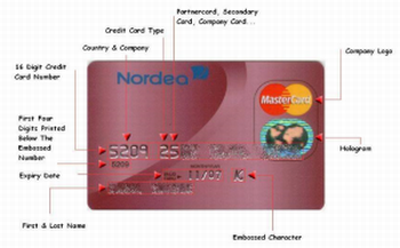

- Keep your card to yourself. Whatever you don’t share your credit card with someone else and when you go to purchase something and only then should you go to pull your credit card out. It only takes a scammer one time to see your credit card numbers on your card. In fact, I had a family member who had this happen to her while going through the check out line at Walmart.

Hopefully, those rules are not too hard to follow but should give you a simple set of guidelines to follow so you don’t get behind on paying them.

Share Your Opinion

Finally, did you just recently get your first credit card? If so feel free to share your opinion and tips to help those who are just getting started.

Excellent, good, fair, or bad credit, you can apply for a credit card here.

5 Comments