Refinancing To An Negative Amortized Loan: The Biggest Mistake I Ever Made

This mistake cost me thousands of dollars in lost principle. What is it? The negative amortized mortgage. In this post I explain this mortgage in depth and why you will never want to do this or you may end up like I did.

This mistake cost me thousands of dollars in lost principle. What is it? The negative amortized mortgage. In this post I explain this mortgage in depth and why you will never want to do this or you may end up like I did.

What Is A Negative Amortized Mortgage

Back about five years ago when I was first getting into financial services I was approached with the idea of refinancing to a negative amortized loan also know as an option arm loan. This is how they explained it.

This mortgage program is an all in one mortgage. With this loan you can make one of four different payments every month. The first payment you can make is a 15 year payment, the second a 30 year payment, third an interest only payment, and finally the last option is the negative amortized payment. I will discuss this in more detail in bit.

So of course I thought this would be a great option considering it would be more flexible, but that wasn’t it. The agent then went on to explain how he recommended I didn’t pay the 15 year, the 30 year, or even the interest only payments.

Instead he recommended that I pay just the negative amortized payment and then save the remaining amount that I would have normally paid on my 30 year fixed mortgage. In my situation I would be saving an extra $250 a month.

At this point everything sounds great but there’s got to be a catch right? The agent went on to explain that this mortgage is adjustable and that the payment amount can adjust by as much as 7.5% or the payment per year. So if I had a $150 payment it could go up as much as $11.50 after one year. Sounds fine, right?

OK, I’m feeling comfortable with the idea of switching to an option arm mortgage and that’s what I did. After the first few years everything seemed to go as plan and then it happened.

How Option Arm Mortgages Really Work

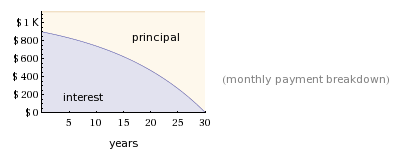

Option arm mortgages sound great in theory but in reality their not so hot. To understand this we need to know how this mortgage really works. If you look at the image below you will see a graph of how a normal 30 year fixed mortgage amortization works.

Notice that in this mortgage you pay mostly interest first and then over time you start pay more principle. With an interest only loan you are only paying a level interest pay and no principle.

So now the question has to be asked who pays the principle in this kind of mortgage? The answer, you do in one lump sum payment at the end of the mortgage.

Finally, if that’s how the interest only mortgage works how does the negative amortized payment work? The negative amortized mortgage works exactly the same as the interest only except for one catch you are not paying the full interest amount due.

So the question has to be asked, what happens to the deferred interest from paying the negative amortized payment? The answer, it gets added back to the loan balance which you still have to pay back.

So why would someone want to make this kind of payment if all it’s going to do is build up your loan balance? The answer, so you can save more money and some day 30 years down the road when the entire principle amount comes due you can pay the entire loan balance in full.

I wish I could say that everything would work out this way but it doesn’t. What I have found is that the money people save eventually gets used for one reason or another and ends in the result of the borrower tacking on thousands of dollars to their mortgage balance which is exactly happened to me.

But that’s not even the cherry on the top yet. To top it off remember about what I said earlier that your payment could increase by 7.5% of your payment per year. That only applies to the negative amortized payment. Which means the other three payments can adjust monthly usually after the first year of the loan. The result was my payment skyrocketed and had no choice but to pay the negative amortized payment.

How To Avoid This Mistake

My advice is pretty simple here if you don’t understand the mortgage and couldn’t explain it to a friend or family member don’t do it. As in my case it took me a few years of paying on this loan until I finally caught on to how the mortgage program actually worked.

Second, stick with something simple. Consult several lenders and banks before deciding on a mortgage program for you. If you have a bank or lender telling you that interest only, negative amortized mortgages, or some other type of mortgage program is the best thing for you just remember my story and walk away.

Chris

This post was recently featured on the Life Tuner Blog Carnival.

2 Comments